Carbon pricing, a solution for the health of the Planet?

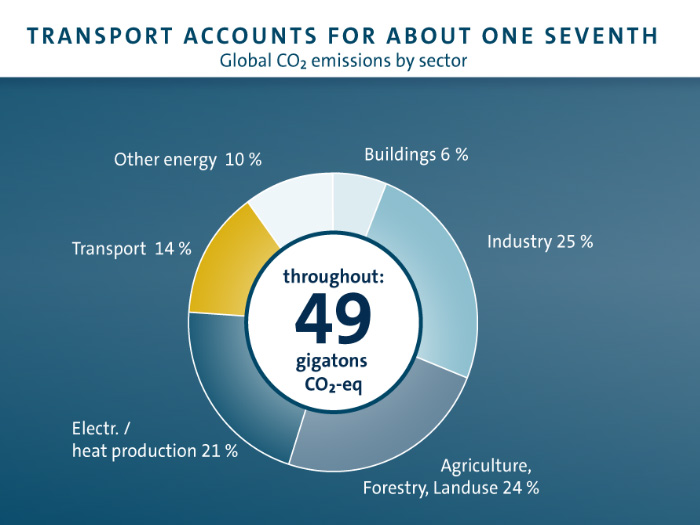

What does it mean to set a price for the carbon dioxide emissions? Is taxing the CO2 produced an effective method? Here’s how the Governments of various Countries are dealing with these issues.

Whether heating, travelling or eating, many activities would become more expensive if a price were put on CO2 emissions. But this approach is regarded as one of the fastest and most efficient means of environmental protection. In the Paris Climate Agreement, the international community agreed to limit the global rise in temperature to under two degrees Celsius – ideally just 1.5 degrees. Experts regard setting a global price for CO2 emissions to be an excellent tool with which to achieve this goal.

The value of CO2

The principle is simple: a ton of CO2 receives a price, for example 30 Euros. Whether it’s in a power plant, factory or apartment, in traffic or out in the fields – wherever CO2 is produced, the amount is due. Clearly, this concept would make all fossil fuels more expensive. In Europe there is already such a model, known as the EU Emissions Trading System (EU ETS), but it only covers the energy sector and parts of the industrial sector. The companies have to certify every metric ton of carbon dioxide they emit, which is currently priced at 25.84 Euros.

The topic is a complex and controversial one, and some Countries have already introduced various versions of this carbon pricing. Let’s take a look at some examples.

Switzerland

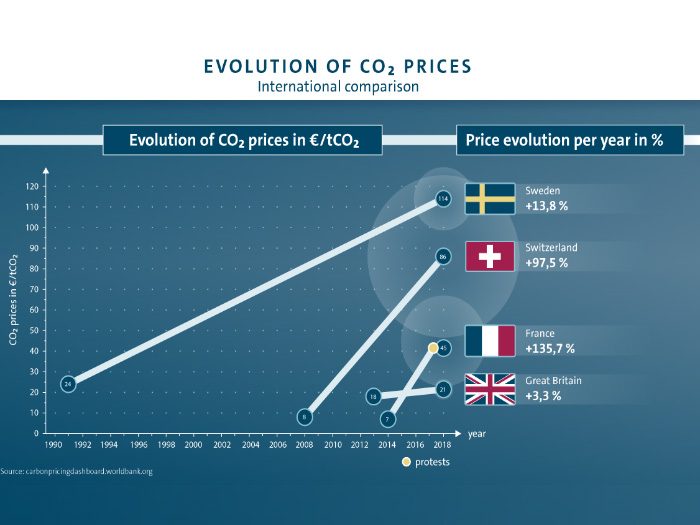

In Switzerland, in addition to a domestic emissions trading system, since 2008 there has also been a so-called incentive tax on heating oil, natural gas and coal. The Swiss started at around 8 Euros per metric ton of CO2, which has now gone up to roughly 86 Euros. Two-thirds of the additional revenues created through this system flow back to citizens through the health insurance system, which attributes the same amount to each insured person. The remaining revenue is used to subsidise energy efficiency-boosting building renovations.

Sweden

Sweden introduced its CO2 tax in 1991 as part of a comprehensive tax reform. It thereby became the first Country to apply a tax to fossil fuels as well as energy and industrial production. Subsequent years saw diminishing emissions in spite of economic growth. When it was introduced, the carbon tax was the equivalent of 24 Euros per metric ton of CO2; today the figure is 114 Euros – the highest price in the world. Thanks to the measures taken, Sweden is well on its way to achieving its goal of being carbon neutral by 2045.

France

France taxes CO2 emissions on the basis of income, and they have the most comprehensive system worldwide according to the World Bank. When the so-called “energy-climate contribution” was introduced, in 2014, it was worth just 7 Euros per metric ton of CO2; by last year the figure was 44.60 Euros. As the energy mix in France contains considerably more nuclear power than coal power, its cost is only marginally higher and the taxes do not have a great impact on transport. The latest planned increase was cancelled after violent protests by the gilets jaunes, or yellow vests, but the French government already supports the expansion of renewable energy sources with current tax income. In recent weeks, France has also announced plans for an environmental tax on aeroplane tickets, which will start at 1.50 Euros for an economy-class ticket for a European domestic flight, rising to up to 18 Euros for non-European international flights in business class.

United Kingdom

The UK introduced the so-called Carbon Price Floor (CPF) in 2013, which supplements the European Emissions Trading System (EU ETS) with a CO2 surcharge pegged at a minimum price, which so far has been above the average set by the European Union. In view of concerns about the competitiveness of energy-intensive industries, in 2015 the CPF was frozen at the equivalent of roughly 20 Euros until 2020. Although the price is relatively low compared to other Countries, some coal-fired power plants went offline in favour of more environmentally friendly gas power plants.

Germany

In Germany, the annual per capita CO2 emissions of 9.6 metric tons are twice the international average. In the EU climate package, Germany committed to reducing its greenhouse gas emissions by at least 40% compared to 1990 by the year 2020. This goal will not be met: reducing CO2 emissions with the existing EU ETS emissions trading system has failed. The plan is therefore to supplement this with a national CO2 minimum price, similarly to how it is done in the UK.

USA

California became the first US state to implement a cap-and-trade program in 2013, launching the second-largest emissions trading system (ETS) in the world after the EU. In this case too, the state caps emissions with certificates rather than a CO2 tax, and the goal of scaling carbon dioxide values back to 1990 levels by 2020 was achieved four years ahead of schedule in 2016. The initial minimum price for a metric ton of CO2 was the equivalent of roughly 8 Euros, which had gone up to approximately 13 Euros by 2018. California’s ETS program covers approximately 80% of greenhouse gas emissions in the state, compared to about 45% for the EU ETS.

China

China produces more than a quarter of global CO2 emissions, and officially launched its national emissions trading system (ETS) in late 2017, with the actual start expected in 2020. Initially the carbon market will only include power plants that produce more than 26,000 metric tons of CO2 annually – a category encompassing 1,700 plants accounting for approximately 30% of China’s total emissions. When the system is initially activated, the emissions certificates will be free. To identify the correct formula for the trading, different pilot projects have been running in seven different cities since 2013, which at least initially will continue to run alongside the national scheme. Although it only involves the energy sector, the Chinese emissions trading system will be the largest in the world.

Source: Volkswagen AG